storytelling + thought leadership

Storytelling + thought leadership

Businesses of all shapes and sizes are now producing content and thought leadership. With so much competition, companies are looking for new ways to engage their audience beyond just a traditional PDF report.

Shorthand is doing some clever things in the digital storytelling space, and brands like the BBC and the Guardian are using it to add depth to their reporting. I've been using Shorthand to bring data-heavy reports to life. By including videos, scroll-controlled charts and bright visuals, the final report is responsive, mobile and much more shareable. See examples below.

The road to

automation

The future of technology in fresh produce

The global fresh produce supply chain is in a state of flux. New commercial models, technological disruption and environmental challenges are causing the food industry to consider how to secure its future and protect margins. But what are the benefits and risks of each new type of technology, and how do they apply to the “just-in-time” complications of the fresh produce industry?

This report was initially designed to be built on Shorthand but the client decided to go with WordPress. I worked with a developer to translate the design and responsive elements onto WP.

| Client: Prophet

| Platform: Wordpress

| June 2021

| road-to-automation.prophetize.com

A voice in

times of crisis

Covid-19 and the marketing function in

legal, professional and financial services

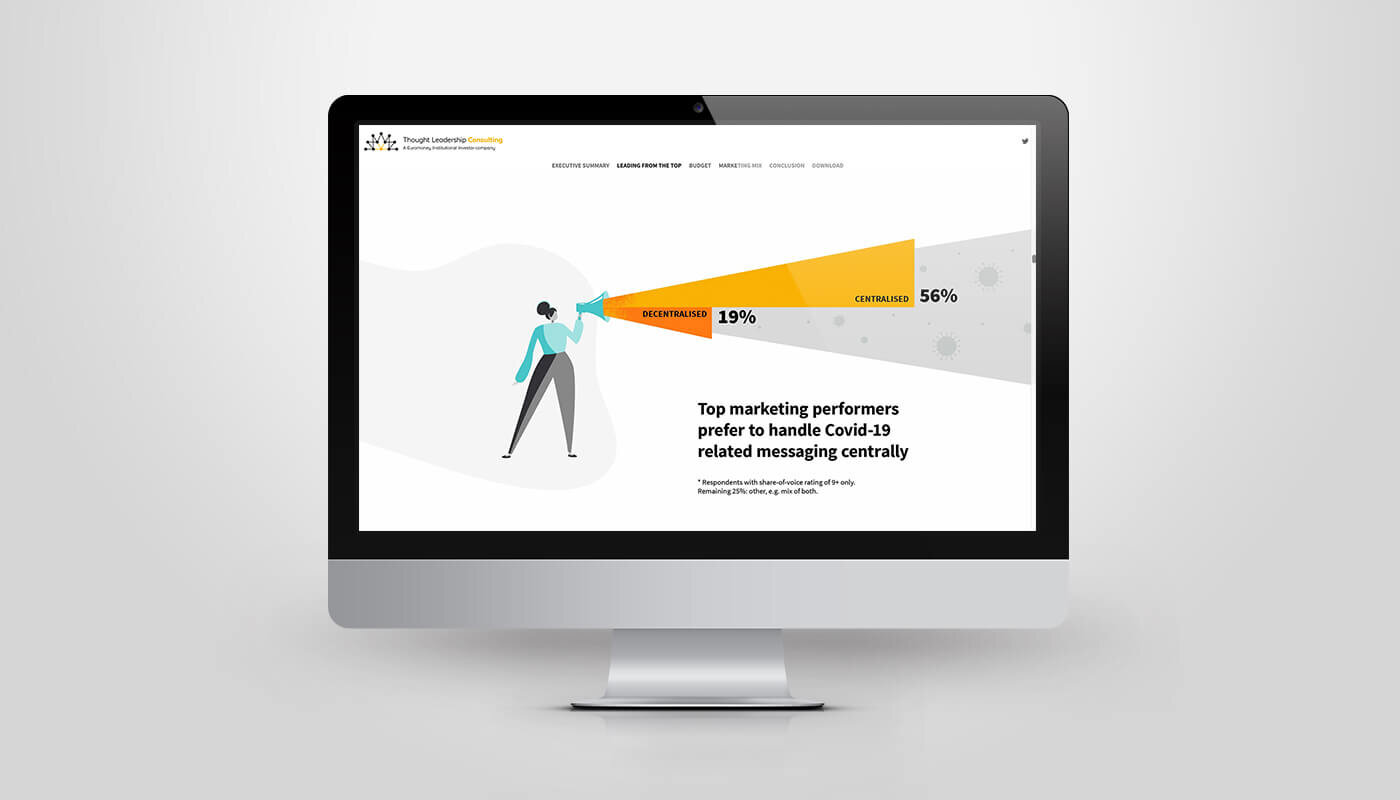

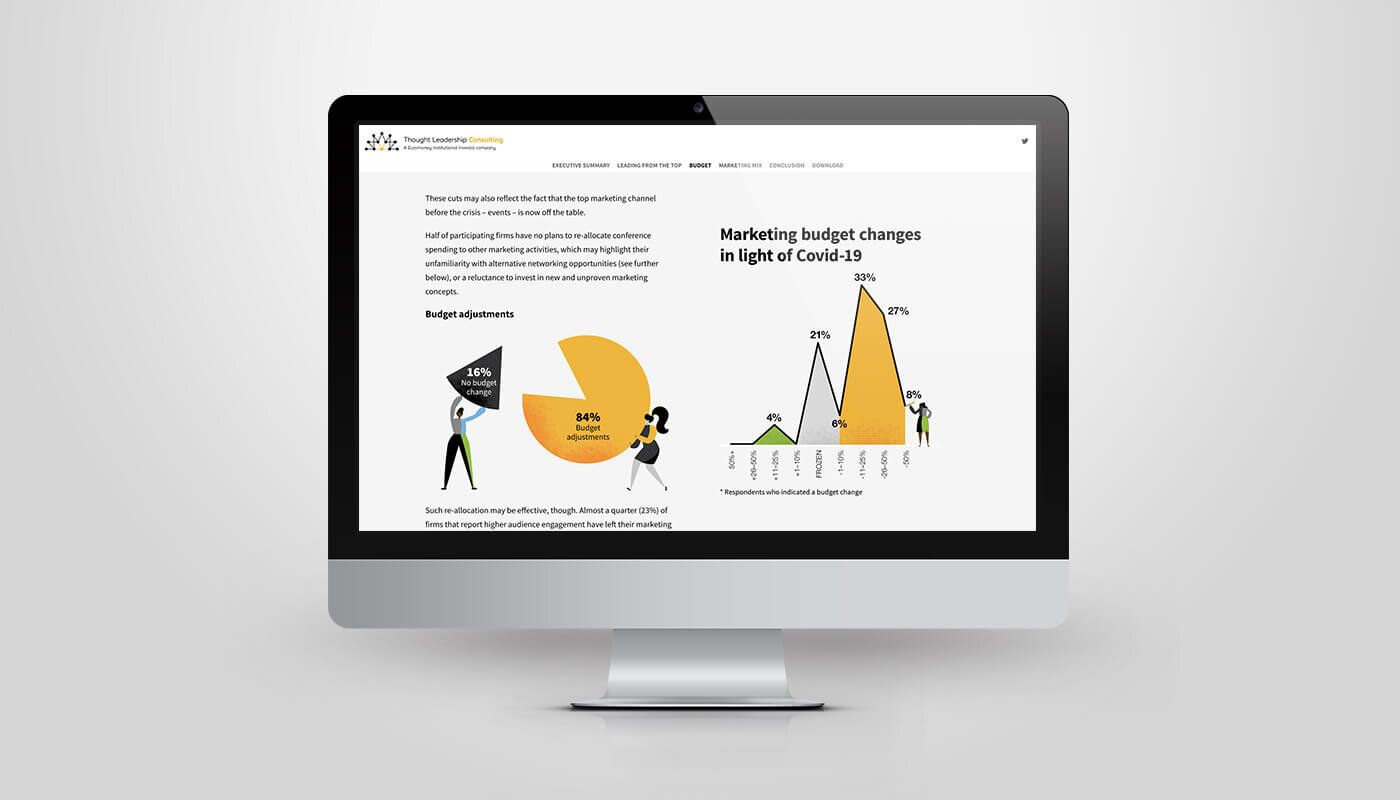

The uncharted waters of the Covid-19 pandemic demand a navigator. Expert advice is more valued than ever and minds are focused, presenting a unique opportunity for legal, professional and financial services to dispense guidance.

Drawing on a series of in-depth interviews and a survey of CMOs and senior marketing experts at legal, financial and professional services firms around the world, this report examines how professional services’ and financial institutions’ marketing functions adjust to a new reality, which changes are most effective and which are set to endure.

| Client: Thought Leadership Consulting

| Platform: Shorthand

| July 2020

| euromoneythoughtleadership.com/voice

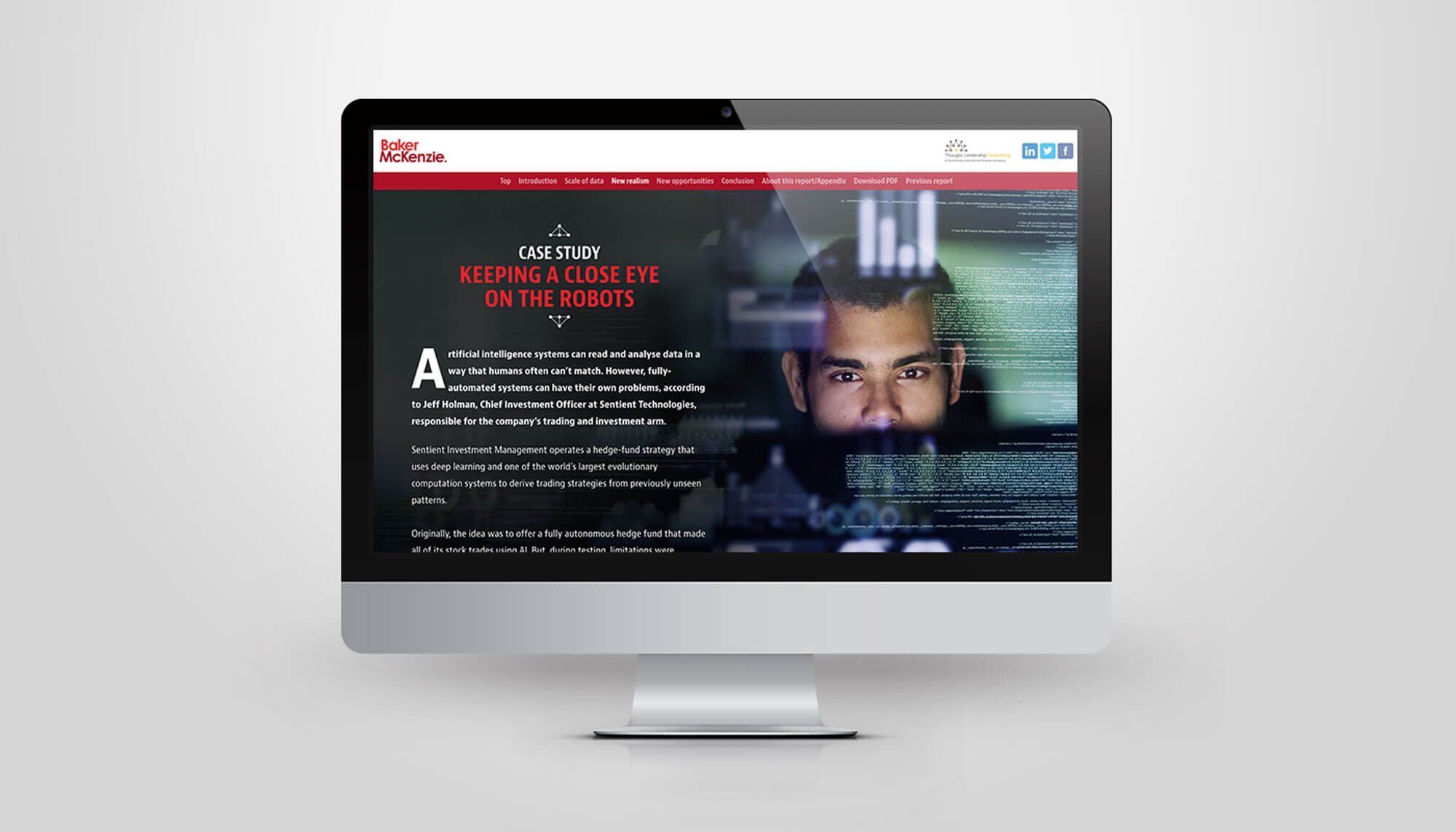

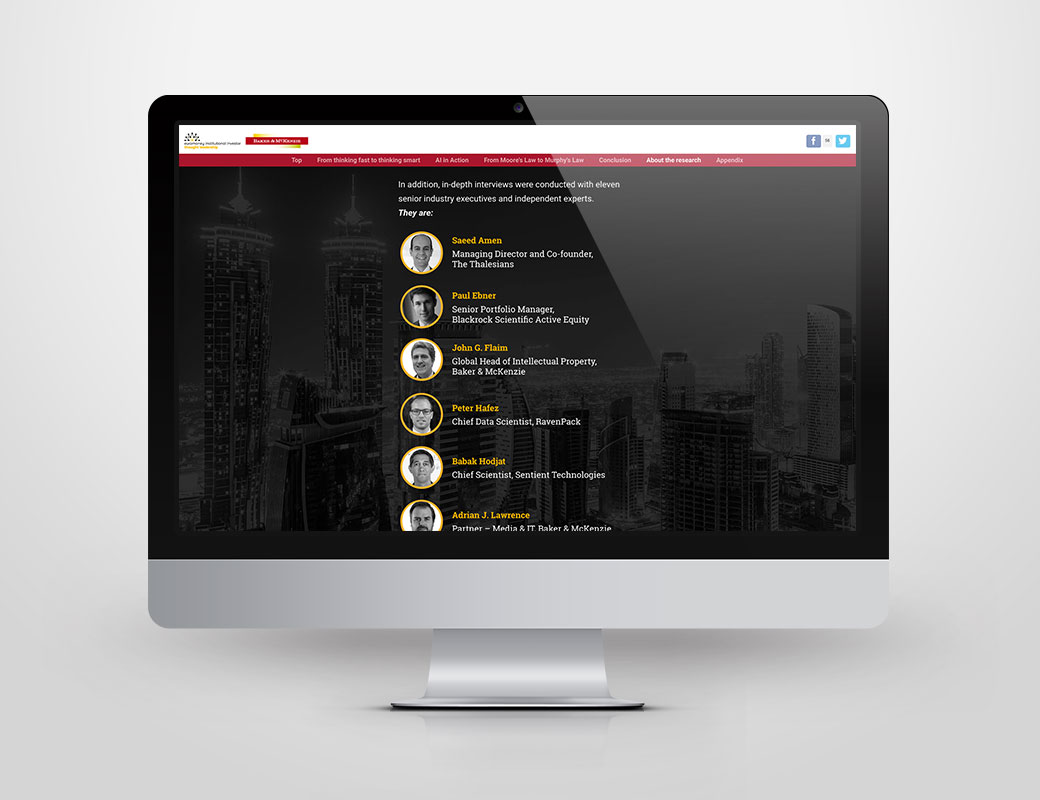

Following the highly successful 2016 report on the future of artificial intelligence in financial services, Baker McKenzie commissioned Thought Leadership Consulting in 2018 to produce an update.

While AI’s potential is huge, much of it is as yet unrealised. Many financial institutions have only begun to scratch the surface of AI functionality as adoption proves more complicated and slower than initial forecasts predicted.

The opportunities and challenges as we edge closer to an AI-centric world are highlighted in Ghosts in the Machine: Revisited, which analyses the findings of a global survey of 355 senior executives from financial institutions and FinTech companies, as well as from in-depth interviews conducted with leading experts in the field.

| Client: Thought Leadership Consulting and Baker & McKenzie

| Platform: Shorthand

| November 2018

| euromoneythoughtleadership.com/ghosts2

Balancing

the books

WINNER:

2017 Shorthand 'Communication With a Difference' Award.

Read the blog post here

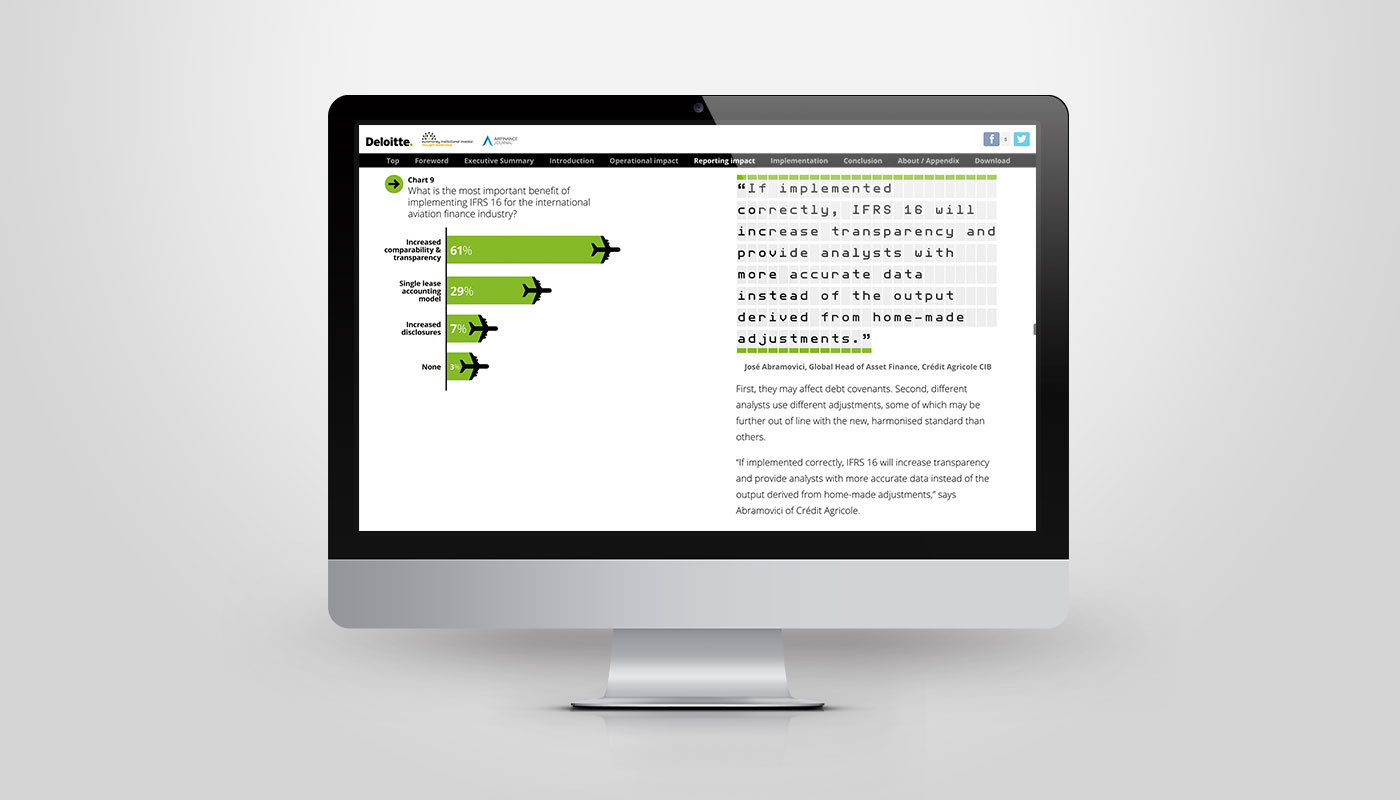

Balancing the Books: IFRS 16 and Aviation Finance is the third Shorthand report I've created for Euromoney Institutional Investor Thought Leadership. For this one, Euromoney worked with Deloitte to look at how the introduction of the new accounting standard IFRS 16 Leases will reshape the balance sheets of most companies that rent valuable equipment.

Drawing on a worldwide survey of 381 senior executives from the aviation finance industry, this study examines the impact of the changes to lease accounting, and what they mean for different stakeholders, with particular attention paid to the often contrasting views of airlines and lessors.

The design uses animated gifs and aviation themed icons in the Euromoney and Deloitte colours. Read my blog post on it here.

| Client: Euromoney Institutional Investor Thought Leadership and Deloitte

| Platform: Shorthand

| December 2017

| euromoneythoughtleadership.com/aviation-IFRS16

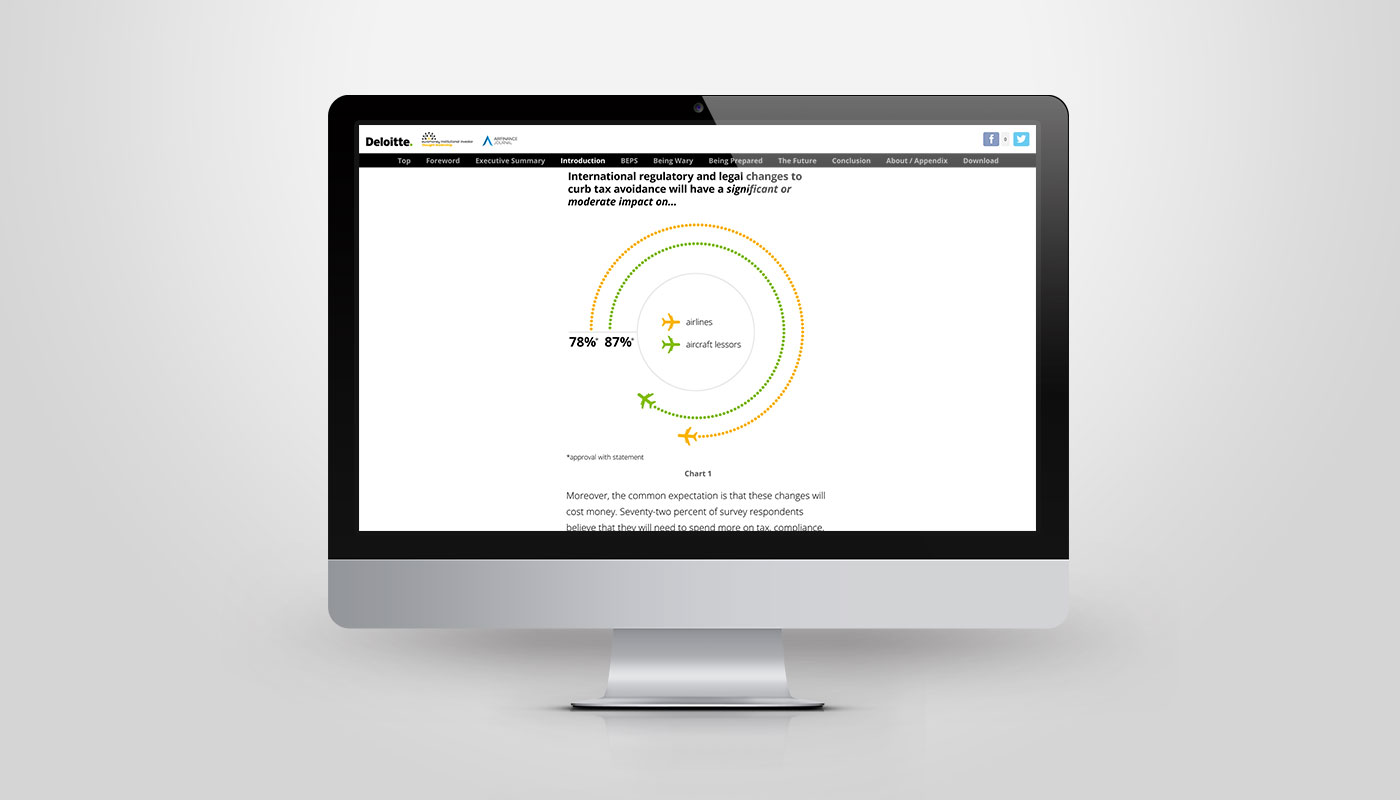

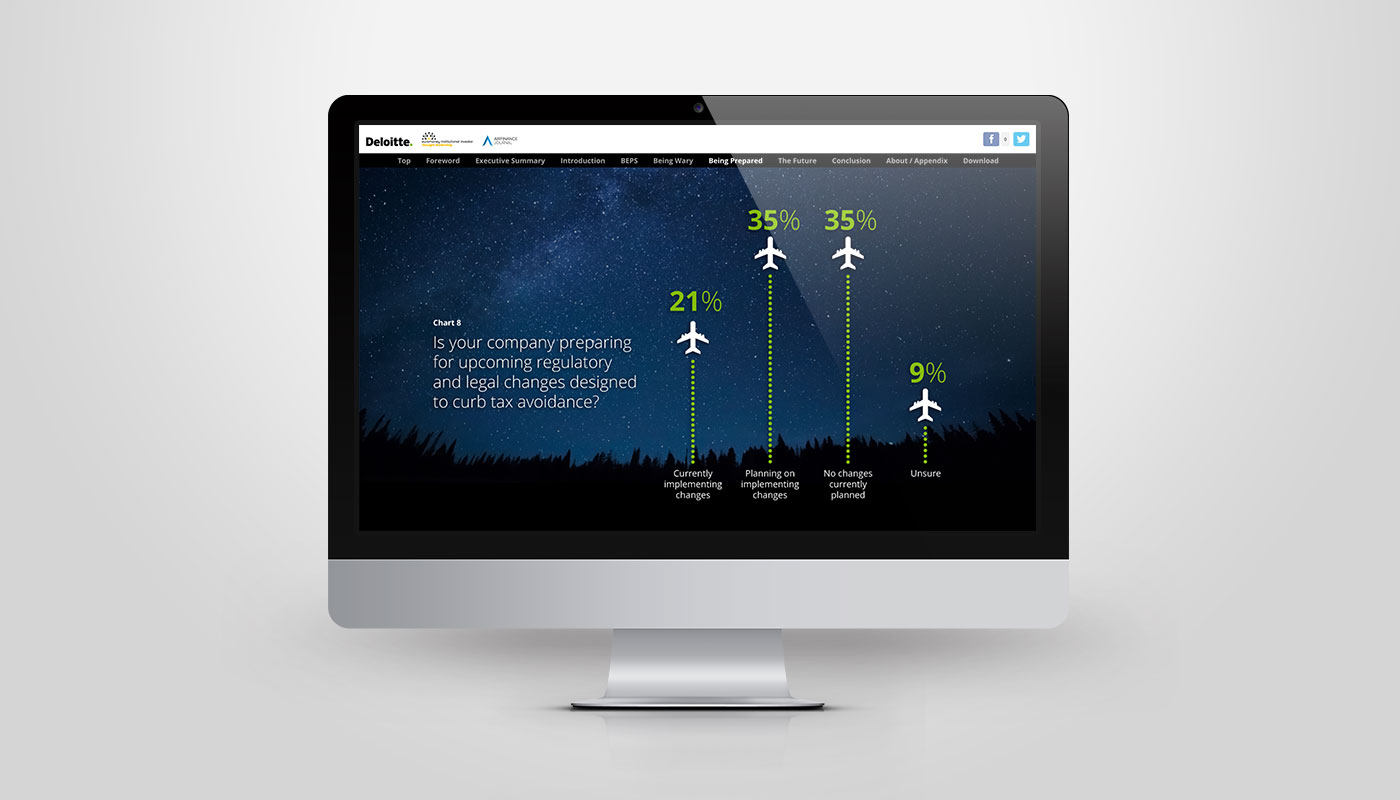

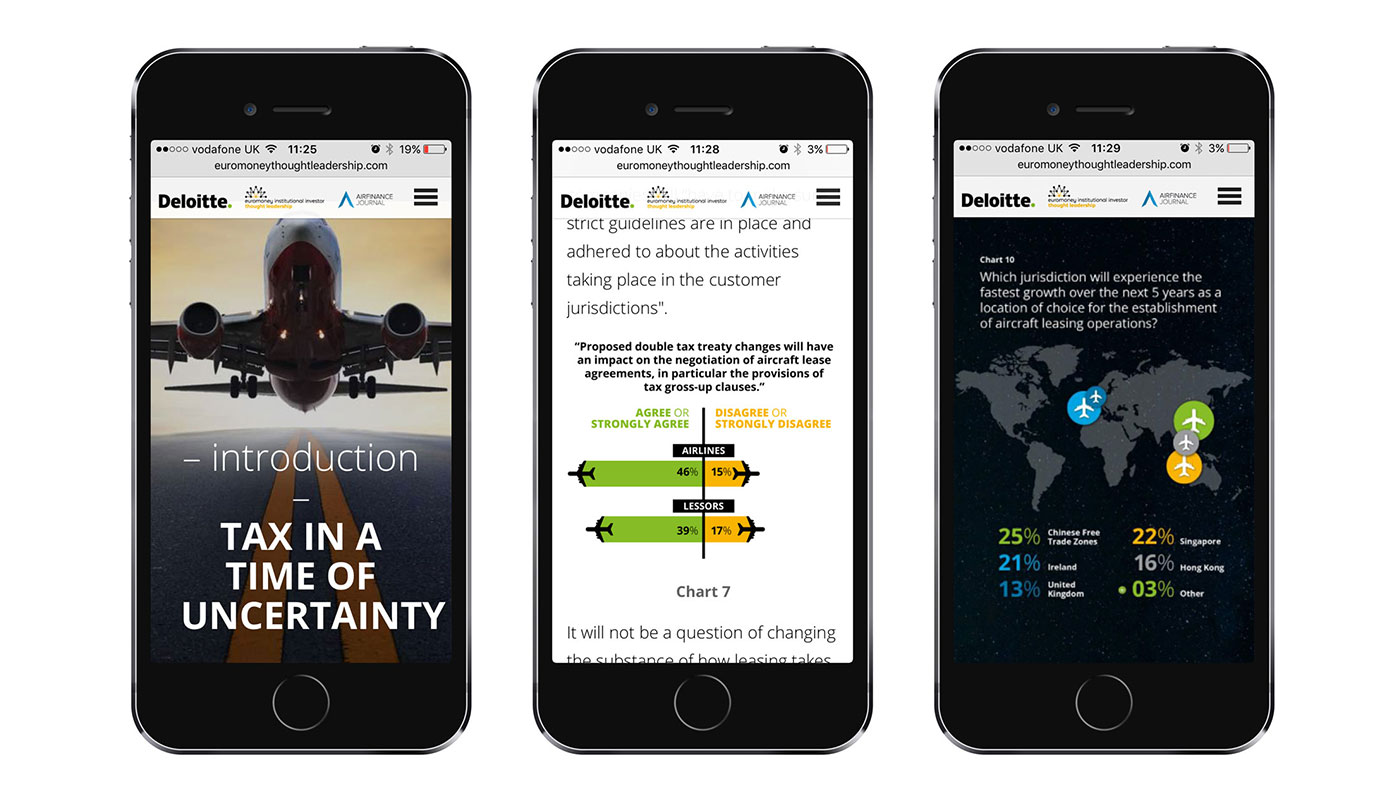

Game changer not game over is a digital report created for Euromoney Institutional Investor Thought Leadership, who worked with Deloitte to dig into the tax and related regulatory challenges facing aviation finance.

Drawing on a worldwide survey of over 400 senior executives from the aviation finance industry as well as in-depth interviews with senior industry executives and independent experts, this study looks at what changes to the tax framework will demand of airlines and aircraft lessors, how firms should be preparing now, and where the future will likely take us.

| Client: Euromoney Institutional Investor Thought Leadership and Deloitte

| Platform: Shorthand

| January 2017

| euromoneythoughtleadership.com/game-changer

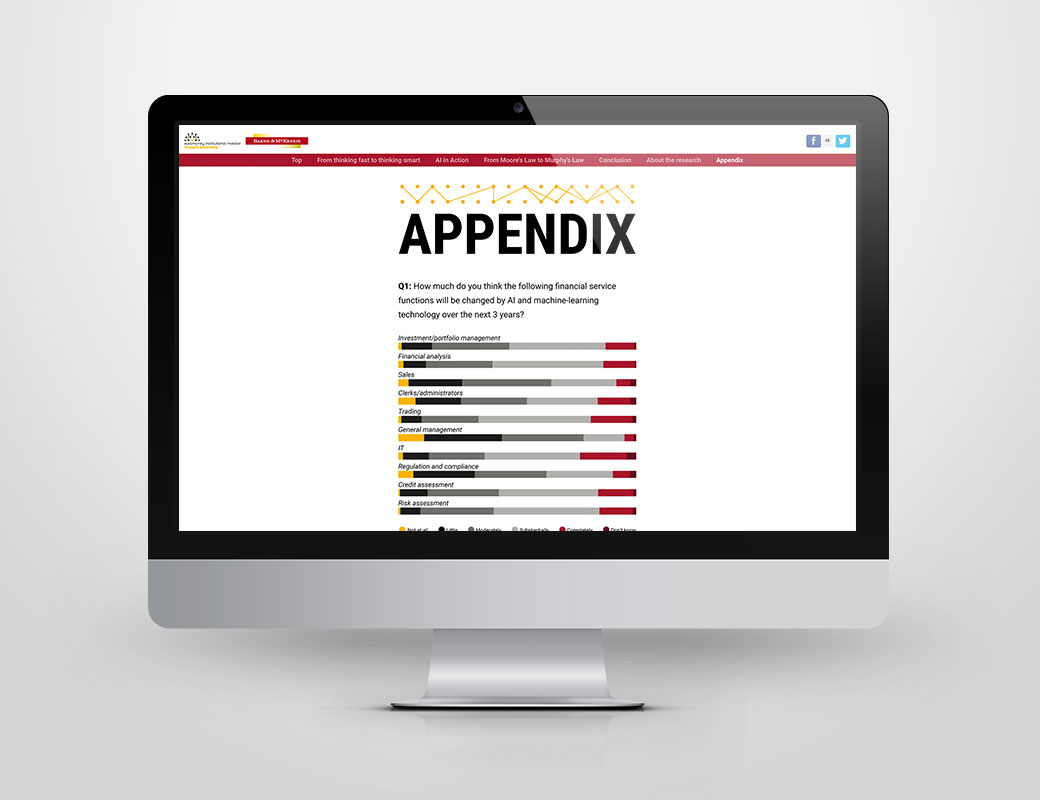

Ghosts in the Machine is a digital report created for Euromoney Institutional Investor Thought Leadership and commissioned by Baker & McKenzie, examining the future of artificial intelligence (AI) in financial markets.

Featuring results of a global survey and interviews with experts in AI, the report uncovers how AI could change the nature of risk, regulation and investment across financial markets.

For more details on the brief and the process, read the blog post I wrote on this project

| Client: Euromoney Institutional Investor Thought Leadership and Baker & McKenzie

| Platform: Shorthand

| April 2016

| euromoneythoughtleadership.com/ghostsinthemachine